All Categories

Featured

Table of Contents

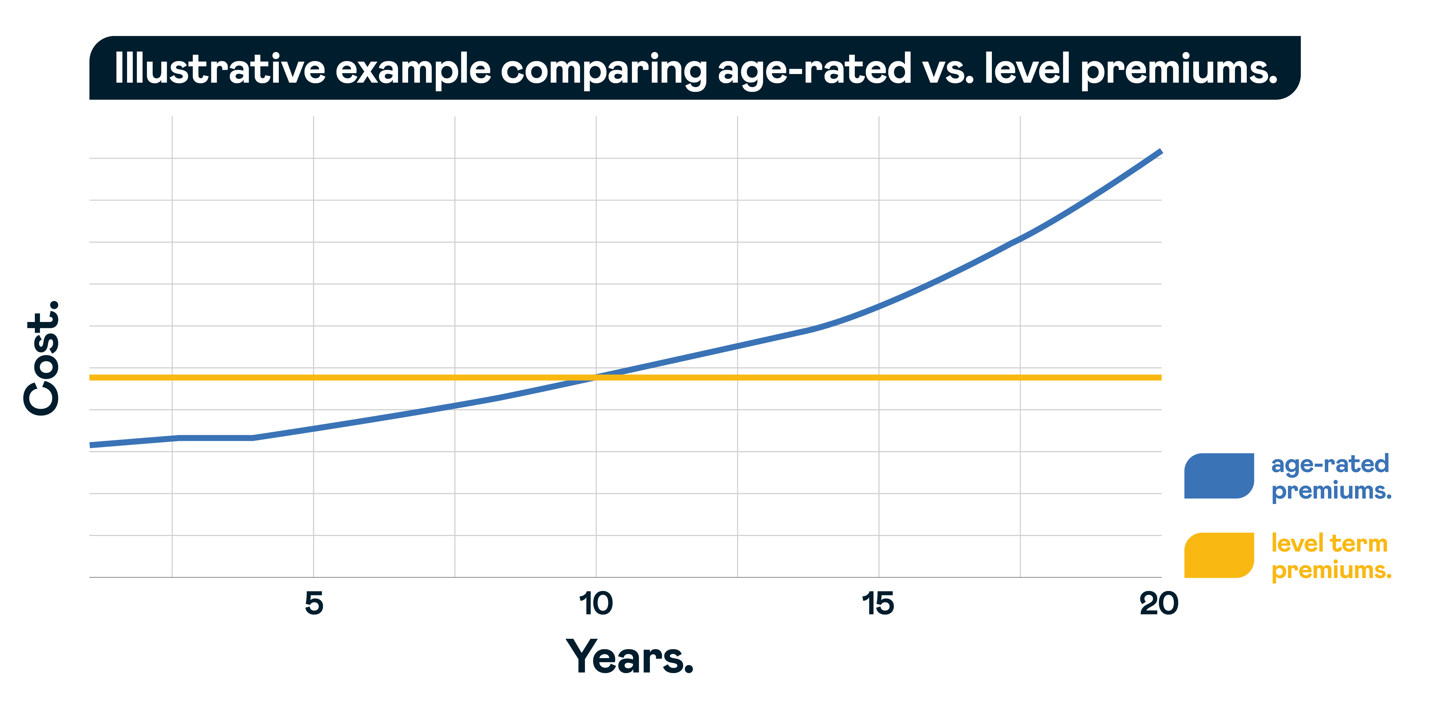

A degree term life insurance policy can give you comfort that the individuals who depend upon you will have a fatality benefit during the years that you are preparing to sustain them. It's a means to help take treatment of them in the future, today. A level term life insurance coverage (occasionally called degree premium term life insurance) plan offers insurance coverage for an established variety of years (e.g., 10 or 20 years) while keeping the costs payments the very same throughout of the plan.

With degree term insurance coverage, the expense of the insurance coverage will stay the exact same (or potentially decrease if dividends are paid) over the regard to your policy, normally 10 or 20 years. Unlike irreversible life insurance policy, which never ever runs out as long as you pay premiums, a degree term life insurance coverage policy will certainly finish eventually in the future, generally at the end of the period of your degree term.

How Does Life Insurance Level Term Work for Families?

Due to this, lots of people use permanent insurance coverage as a stable economic planning tool that can offer many needs. You might have the ability to transform some, or all, of your term insurance policy throughout a collection duration, commonly the initial one decade of your policy, without needing to re-qualify for protection even if your health has transformed.

As it does, you may want to add to your insurance coverage in the future - Term life insurance for couples. As this occurs, you may desire to ultimately lower your death benefit or consider transforming your term insurance coverage to a long-term policy.

Long as you pay your costs, you can relax simple understanding that your enjoyed ones will obtain a death benefit if you die during the term. Numerous term plans permit you the capacity to convert to permanent insurance coverage without having to take another health test. This can enable you to capitalize on the fringe benefits of a permanent policy.

Level term life insurance policy is just one of the most convenient paths right into life insurance policy, we'll discuss the advantages and downsides so that you can choose a strategy to fit your demands. Degree term life insurance policy is one of the most usual and fundamental kind of term life. When you're searching for short-term life insurance policy plans, degree term life insurance coverage is one route that you can go.

The application procedure for degree term life insurance policy is commonly very uncomplicated. You'll submit an application that has basic personal info such as your name, age, etc along with a more thorough set of questions regarding your clinical history. Depending on the plan you want, you might need to get involved in a medical checkup process.

The short response is no., for example, allow you have the comfort of fatality advantages and can build up money worth over time, meaning you'll have a lot more control over your advantages while you're alive.

What is What Is Direct Term Life Insurance? An Essential Overview?

Riders are optional stipulations added to your policy that can offer you added benefits and protections. Anything can occur over the training course of your life insurance policy term, and you desire to be all set for anything.

This biker supplies term life insurance policy on your youngsters via the ages of 18-25. There are instances where these advantages are built right into your plan, however they can likewise be readily available as a separate addition that requires extra payment. This cyclist gives an additional death benefit to your recipient should you die as the outcome of a crash.

Table of Contents

Latest Posts

Funeral Policy Online

Burial Insurance Near Me

Burial Policy Vs Life Insurance

More

Latest Posts

Funeral Policy Online

Burial Insurance Near Me

Burial Policy Vs Life Insurance